A whitepaper on transition from employment uncertainty to programmable paydays.

Abstract

For most of modern history, “income” meant a paycheck: a promise from an employer, denominated in the local currency, arriving on their schedule. Today, a parallel idea is gaining traction: income you can simply purchase anonymously, at a substantial discount, and on your schedule.

Instead of trading hours for wages, participants buy contract rights to future paydays produced by hybrid financial instruments that have not been available until recent technological advancements. The combination of traditional bank lending, insurance backing, and the invention of decentralized finance (DeFi), digital asset capabilities, and the trustless crypto environment now make this idea possible.

One manifestation of this paradigm shift is a program called Cryptex. It is designed to transform a small activation payment into exposure to a larger programmatic cash-flow engine and to deliver a residual payday in bitcoin at maturity. Whether you ultimately participate or not, understanding how this works is empowering knowledge in the new landscape of “purchasable income.”

The Components

In this model, “purchasing a paycheck” is really about combining old strengths with new rails. Traditional finance (TradFi) provides scale and risk-transfer (banks and insurers). New technologies provide programmable execution and compounding (DeFi, liquidity pools, smart contracts). The value emerges when these pieces are combined: off-chain capital funds along with on-chain strategies. Time is the final piece of the puzzle that when introduced provides significant financial value to the system. Payouts are settled in a cryptocurrency unit of choice (here, bitcoin). All parties remain anonymous and never require trust from each other in order to profitably interact.

- Participant: - Activates a contract with $100 and receives the residual payout at maturity in Bitcoin (BTC).

- Lending Bank (TradFi): - Supplies working capital for a fixed term; expects annual interest coupon and return of principal.

- Insurance Underwriter (TradFi): - Prices and backstops the loan; gets monthly premiums and stands behind unforeseen events.

- Program Administrator (Cryptex): - Orchestrates the structure and policies; coordinates parties and terms, services obligations.

- DeFi Liquidity Pools / Automated Market Makers (AMM): - Always-on markets that collect swap fees; core source of small, repeatable profits.

- Market-Making / Basis / Funding Strategies: - Programmatic trades that harvest tiny spreads and roll them forward.

- Smart Contract / DeFi Hybrid Contract: - The rules engine that enforces terms and routes funds as conditions are met.

- Decentralized Oracle Network: - Brings off-chain facts on-chain (time elapsed, interest due, maturities) so code can act.

- Exchanges / On-Ramps: - Convert fiat to crypto and move funds into the program wallet.

- Wallet / Custody: - Holds participant assets securely; receives the BTC payout at maturity.

- Bitcoin Network (Settlement Asset): - The scarce unit (21 Million cap) in which the participant’s residual is paid.

- Time: - Powerful component when paired with daily compounding.

Together these players turn capital + code into a predictable cash-flow engine—traditional protections on the outside, programmable compounding on the inside.

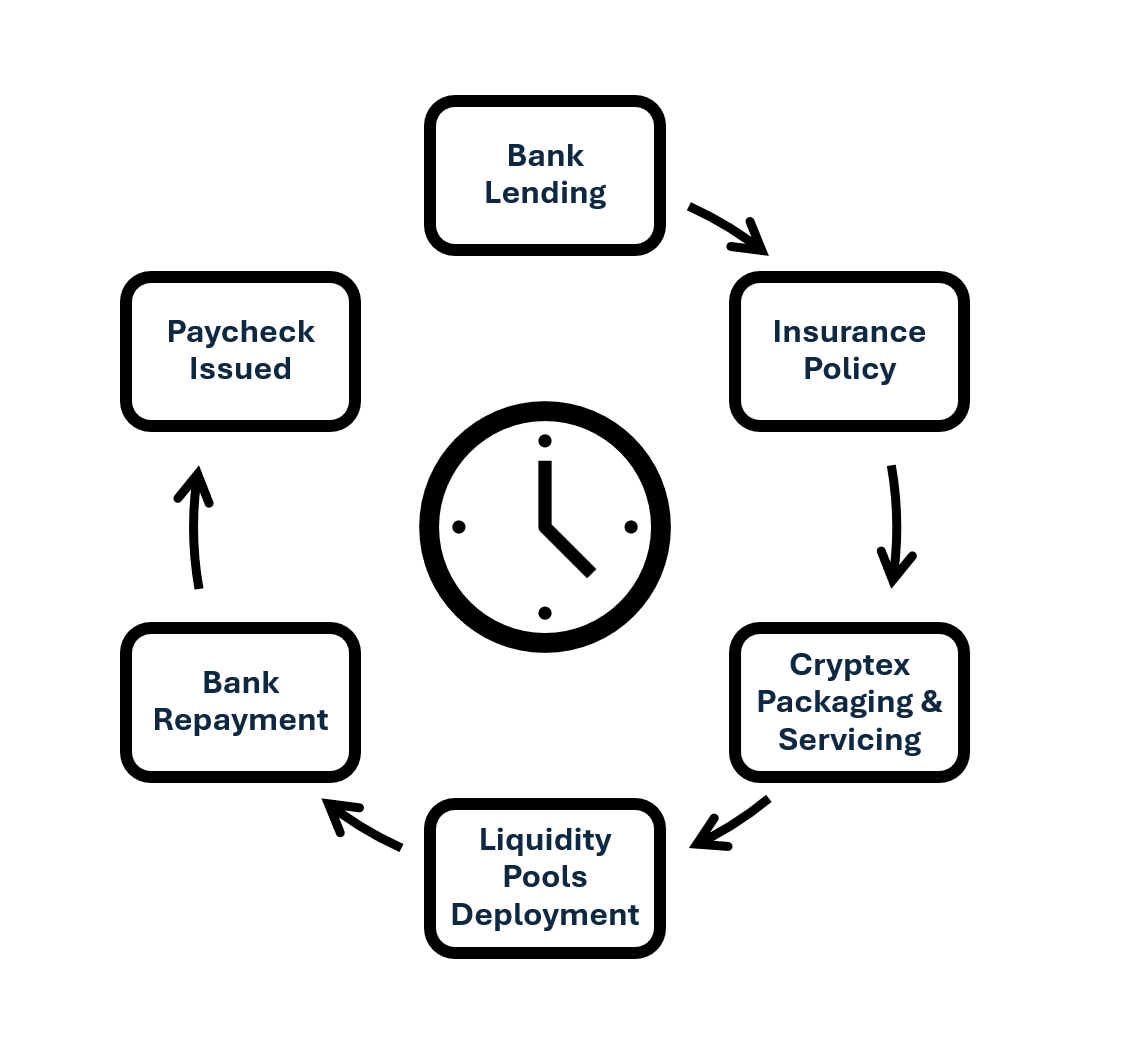

The Roadmap

Think of the “purchasable paycheck” as a loop that runs on a schedule. Traditional players unlock capital; Cryptex’s hybrid contracts route that capital into on-chain strategies; obligations are serviced along the way; the loop closes with a BTC payout to the participant.

1. Bank lending (start).

An anonymous bank approves a fixed-term loan (e.g., 2, 3, 5, 7 or 10 years). This is the working capital that will actually go to work; the $100 simply activates the contract.

2. Insurance policy (risk backstop).

An insurer issues a lender-protection policy on that loan. With the policy in force, the bank’s capital is “good to go,” and the program can deploy it.

3. Cryptex packaging & servicing (the wrapper).

Cryptex creates an individual DeFi Hybrid Contract for your chosen term. The contract sets the calendar (premium due dates, annual interest-only settlement to the bank), permissions, and risk limits. It also registers the contract with an oracle schedule (see “How the oracle works” below).

4. Liquidity pools deployment (the engine).

Capital is allocated across DeFi venues—primarily AMMs/liquidity pools and related market-making/basis/funding strategies. Small fees earned throughout the day are harvested and compounded back into the program, growing the base before obligations are netted.

5. Servicing during the term (keeping the lights on).

From the daily compounding profits, Cryptex services monthly insurance premiums and makes the annual interest payment to the bank (approximately 6.75% APR). If a venue underperforms, allocations adjust; the priority is meeting dated obligations on schedule.

6. Bank repayment (maturity event).

When the oracle confirms the term is complete, the contract nets results: the bank’s principal is returned; the insurer is settled; remaining funds are set aside for payout.

7. Paycheck issued (to the participant).

The residual is paid in bitcoin (or digital asset of choice) to the participant’s wallet—separate from the bank and insurer flows. Post-payout, participant decides whether to hold BTC or convert.

How the oracle works (plain English).

A decentralized oracle network acts like a timekeeper + notary: it posts signed, tamper-resistant updates on chain (e.g., “30 days passed—premium due,” “12 months elapsed—interest settlement,” “term complete—trigger maturity”). The hybrid contract listens for these oracle signals and automatically executes each step, keeping off-chain obligations in sync with on-chain actions.

Whitepaper Summary

In short, “purchasing a paycheck” means activating a structure—rather than investing a pot of your own money—that marries traditional capital with programmable markets. A bank extends working funds for a fixed term, an insurer backstops that loan, and Cryptex packages the deal as a hybrid contract. Those funds—not the participant’s $100 activation fee—are deployed across DeFi venues via staking contracts where small, frequent fees are harvested and compounded. A decentralized oracle network acts as the timekeeper and notary, cueing each off-chain obligation on chain: monthly insurance premiums, annual interest-only payments to the bank, and the final maturity paycheck.

When the term ends, principal flows back to the bank and the insurance policy is settled. What remains—the residual created by compounding after obligations—is issued to the participant in bitcoin. That’s the core idea and the full loop: traditional protections at the perimeter, automated cash-flow generation inside, and a payout in a scarce digital unit. All participants interact anonymously and efficiently. With the concept, the players, and the roadmap established, we can now turn to the Cryptex-specific mechanics and terms that make this particular implementation work profitably.